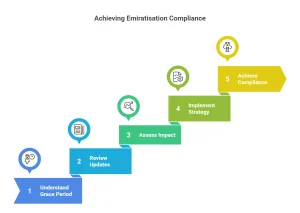

Emiratisation deadlines are closing in, and the grace period is your chance to get ahead. This limited window allows businesses to fulfill compliance requirements before facing fines and scrutiny. This emiratisation compliance grace period is also a strategic opportunity, as companies that treat it as a growth lever now will be better positioned to compete and thrive in the market tomorrow.

In this blog post, we will discuss how the grace period works, why it exists, the latest updates you can’t afford to miss, its direct impact on your business strategy in 2025, and the exact steps you should take now.

What is the Emiratisation Compliance Grace Period?

We mentioned incentives and deadlines in the opening paragraph of this blog post. But first, we answer what exactly the emiratisation compliance grace period is.

Definition & Purpose of Grace Period

The Emiratisation compliance grace period is the extra time given by the UAE Ministry of Human Resources and Emiratisation for companies to meet their hiring targets of UAE nationals.

Why the UAE Introduced a Grace Period

UAE’s government recognizes it takes time to hire qualified Emirati talent, onboard them, and adapt the program to the HR practices. That’s why the grace period was introduced in the first place. Its purpose is to help businesses transition.

Latest Updates on Emiratisation Compliance

In this section, we discuss the latest updates on Emiratisation compliance and when it is supposed to be implemented:

Deadlines & Key Dates from MOHRE

For 2025, MOHRE has set clear milestones. Private sector companies must meet their Emiratisation targets by specific deadlines. If your company hasn’t aligned with it yet, the grace period is likely your last chance before automatic penalties kick in.

Industries Most Affected by Emiratisation Rules

Industries are facing different pressure levels. Having a larger workforce on board and a heavy reliance on skilled labour causes the sectors of finance, tech, and trade to face stricter oversight.

Industries Affected

- Finance & Banking – High demand for Emirati professionals with compliance scrutiny.

- Technology & Trade – Expected to expand Emirati participation rapidly.

- Construction & Manufacturing – Moderate targets but still under monitoring.

Companies in these industries must act proactively, as MOHRE closely tracks hiring ratios and monthly updates.

Who Needs to Meet Emiratisation Requirements?

If you’re still unsure whether your company is affected, this is where it gets clear.

Applicability for Private Sector Companies

All private sector companies above a certain employee threshold must comply. This means if you’re registered in the UAE and employ a workforce beyond the minimum set by MOHRE, you’re in the compliance zone.

Small & Medium Enterprises (SMEs)

SMEs often wonder if they’re exempt. The truth is that some SMEs may get more lenient targets, but that doesn’t mean they can ignore the rules altogether. For SMEs, the grace period is even more valuable. It offers them enough time to adjust hiring strategies and not be charged with immediate penalties.

Large Corporations

Big names don’t get special passes. In fact, large corporations are expected to set the tone for compliance. Since they have deeper hiring capabilities and HR resources, MOHRE looks at them closely. Non-compliance here isn’t just about fines. It can damage reputation and relationships with regulators.

Free Zone Companies

Currently, free zone companies are not legally required to meet Emiratisation quotas. However, many are encouraged to hire Emiratis through initiatives such as the Nafis program, as future regulations may extend localization policies to free zones.

And that ties us directly into the next big question: what happens if companies don’t comply once the grace period ends?

Penalties and Fines After the Grace Period Ends

This is where the grace period shows that it is a temporary shield.

Emiratisation Fines Explained

Once the grace period ends, companies face monthly fines for every Emirati role they fail to fill as per their quota. These fines are not one-time. They continue until compliance is achieved.

- AED 8,000 per month per unfilled Emirati position starting July 1, 2025

- Fines increase annually if non-compliance continues

- Companies with repeat violations risk suspension of new work permits and potential government blacklisting

Avoiding Non-Compliance Penalties

Avoiding these fines isn’t complicated, but it does require action now. Start recruitment early, invest in training, and tap into MOHRE’s support programs. In the next section, we’ll break down what exact steps companies can take and what official tools exist to help.

How to Ensure Emiratisation Compliance in UAE

Emiratisation Compliance Checklist 2025

- Verify your Emiratisation quota via the MOHRE portal.

- Register on Nafis and post open roles for Emirati talent.

- Audit your current workforce and identify positions for localization.

- Document recruitment and training initiatives to show compliance readiness.

- Implement mentorship programs to retain Emirati employees.

- Review quarterly progress through the MOHRE dashboard.

Steps for Companies to Prepare

Companies should begin by auditing their current workforce, identifying required Emirati hires, and launching recruitment plans. Partnering with recruitment specialists who understand the local market can save months of trial and error.

Tools & Resources from MOHRE

MOHRE offers digital platforms that track compliance and provide access to Emirati talent pools. Businesses can also access advisory services that explain quota calculations and hiring expectations in plain terms.

Legal Support and HR Best Practices

Alongside MOHRE’s tools, companies benefit from legal consultations and HR restructuring. For example, adjusting job descriptions to attract Emirati talent, aligning salaries with expectations, and setting mentorship programs can all help long-term retention.

Benefits of Complying with Emiratisation Rules

Following the emiratisation rules offers you these advantages:

Financial Incentives & Support

UAE offers incentives like reduced fees and priority services for companies that meet or exceed Emiratisation targets. These offered savings and benefits are substantial enough even to offset the initial hiring costs.

Building a Sustainable Workforce

Beyond financial perks, compliance helps create a stronger, more stable workforce. Emirati employees bring local knowledge, cultural alignment, and long-term commitment that add real value to businesses operating in the UAE.

If we tie this back to the start, the grace period is a chance to set up a workforce strategy that lasts.

Final Thoughts

The Emiratisation compliance grace period is a lifeline. Companies that treat it as extra time to get serious about compliance will strengthen their workforce, access government incentives, and prevent getting fined.

If you are still wondering where to start, this is exactly where we step in. Our Emiratisation services in UAE help businesses like yours meet compliance without the confusion. Get in touch today, and let’s make sure you use that grace period smartly and strategically. Contact us now for our services.

FAQs on Emiratisation Compliance

1. What happens if a company misses the Emiratisation deadline?

If a company fails to meet its Emiratisation quota by June 30, 2025, fines of AED 8,000 per unfilled Emirati role per month will apply automatically.

2. Can companies request an extension beyond the grace period?

Extensions are rare. Unless MOHRE announces a policy change, businesses should not rely on any additional leniency.

3. How is Emiratisation compliance measured?

MOHRE calculates compliance based on the number of Emirati employees registered, the company’s sector, and total workforce size. All data is updated in real-time through the MOHRE digital system.

4. Is Emiratisation mandatory for free zone companies?

Currently, no — but free zones are encouraged to adopt localization policies voluntarily, and upcoming reforms may bring similar obligations.

5. What are Nafis’ incentives for employers?

Employers who hire Emiratis through Nafis can access salary subsidies, training programs, and government fee reductions.

6. What happens if an Emirati employee resigns?

The company must replace the employee within the same quarter to maintain compliance; otherwise, the vacancy counts toward the non-compliance quota.