To salary check UAE, it is important that you are aware of the employment laws and labour regulations applicable in the region where you work. Companies operating outside free trade zones must comply with the labor regulations of the Ministry of Labor. Meanwhile, those located within free trade zones must adhere to the rules established by the authorities in those zones. Furthermore, it is essential to understand the specific regulations governing their operations

In this article, we talk about salary check UAE, Abu Dhabi salary check, and how to understand the UAE wage protection system.

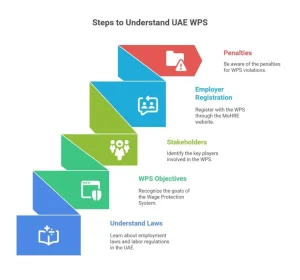

Understanding the UAE Wage Protection System (WPS)

The Wage Protection Scheme (WPS) in the United Arab Emirates (UAE) is a government initiative to ensure that employees receive their salaries in full and on time. Here is a detailed explanation of how it works:

Objectives of the WPS

- For secure employees’ wages.

- To protect the interests of the employer.

- And to reduce the time and effort needed to pay wages.

- Also, improve job security and employee-employer relations.

- Establish a transparent and user-friendly payment system.

- Create an up-to-date database for the Ministry of Labour.

- Reduce wage-related labour disputes.

Stakeholders

- Employees and employers.

- Banks and agents authorised by the Central Bank of UAE for the payment of wages.

Employer registration

- Employers can register with the WPS through the official website of the Ministry of Human Resources and Emiratisation (MoHRE).

- So, they must provide bank account information, a list of employees, and the date of salary payment.

Penalties for violation of the WPS

- Entering incorrect data in the WPS for evasion purposes: Dh5,000 per employee, up to a maximum of Dh50,000.

- Besides, failure to pay on due dates: Dh1,000 per employee.

- As well, forcing employees to sign false pay slips: Dh5,000 per employee.

The WPS was launched in 2009 and strengthened in 2016, and covers all institutions registered with MoHRE in all industries.

Different Ways to Check Your Salary in the UAE

In the United Arab Emirates (UAE), there are several ways to salary in check UAE:

- Contract Review: Your employment contract is the main document that details your salary and benefits. Make sure you have a copy and understand the terms.

- Pay Stubs: Employers must provide pay stubs detailing gross salary, deductions, and net salary.

- Human Resources (HR) Department: Besides, you can request a detailed explanation of your salary and any deductions from your HR department.

- Wage Protection System (WPS): This is an electronic system that allows companies to pay wages through banks, bureaux de change, and financial service providers authorised by the Central Bank of the UAE.

- Bank Enquiry: If your salary is directly deposited into your bank account, you can check your bank statements to verify payments received.

- Ministry of Human Resources and Emiratisation (MoHRE): If you have questions or problems with your salary, you can contact MoHRE for assistance or to file a complaint.

- Legal advice: Also, in case of discrepancies or wage disputes, you can seek legal advice to understand your rights and options.

It is important to be aware of your rights and responsibilities under UAE labour laws and to maintain open communication with your employer about any salary concerns.

Online Salary Check via the Ministry of Human Resources & Emiratisation

To check salary online UAE through the Ministry of Human Resources and Emiratisation (MoHRE) of the United Arab Emirates, you can follow these steps:

- First, access the official MoHRE website. Visit the MoHRE website to start the process of an online salary check.

- Then, register or log in. If you already own an account, use your login credentials. Otherwise, you will need to register by providing the required information.

- Besides, navigate to the online services section and look for the option related to Wage Verification or the Wage Protection System (WPS).

- Also, enter the required information. This could include your personal identification number, employer details, and other relevant information to verify your wages.

- Finally, salary check UAE details. Once you enter the requested information, you will be able to view your salary details, including pay dates and amounts.

- It is important that you have all the necessary documentation, such as your personal ID and employment contract details. Furthermore, these documents will facilitate the process of salary check UAE.

Checking Your Salary Through Your Employer’s Portal

To check a job salary through the employer portal in the UAE, you will generally need to follow these steps:

- You must first access the Portal. Visit your employer’s official website or the portal provided for employee management.

- Also, after logging in, use your login credentials, which may include your employee identification number, username, or email and password.

- Firstly, you will need to navigate to the Payroll Section. Next, find the section of the portal where salaries, payments, or payroll are managed.

- So, once you find the wages section, you should review the information. In this section, you should be able to see details such as your gross pay, deductions, net pay, and any other benefits or compensation.

- Lastly, make sure to download or print your pay stubs. If you need a physical copy of your pay stub, look for the option to download or print.

- It is important to keep your login information secure and be sure to log out after reviewing your personal information on a public or shared portal.

Utilizing Payroll Cards for Salary Access

Payroll cards in the United Arab Emirates (UAE) are a convenient and secure way to access your salary. Here is how you can use them:

- Receive Salary: Your employer will deposit your salary directly onto the payroll card each payday.

- Using the Card: Also, you can use the payroll card as a debit card to make purchases, withdraw cash at ATMs, and pay bills.

- Access to Funds: Besides, you are guaranteed access to your full net pay at least once per pay period at no additional cost.

- No Bank Account Required: As well, you do not need to have a bank account to get a payroll card, as it is a prepaid card.

- Security: Using a payroll card is safer than carrying cash and can be more economical than using check cashing services.

- Flexibility: If you decide you prefer another payment method, such as direct deposit, you can switch from the payroll card at any time.

- Privacy: Your employer does not have access to your payroll card transaction history.

So, it is crucial to review the specific terms and features of the payroll card offered by your employer, as they may Furthermore, make sure you understand any fees associated with the use of the card to avoid unnecessary costs.

FAQs

Some frequently asked questions (FAQs) about salary check UAE are:

How can I verify my salary in the UAE?

You can salary check UAE in your employment contract, using the Wage Protection System (WPS), checking with your company’s human resources department, or through your bank account if your salary is direct deposited.

What is the Wage Protection System (WPS)?

The WPS is an electronic system implemented by the UAE government to ensure that employees receive their salaries in a timely and complete manner.

What should I do if there is a discrepancy in my salary?

You should contact your company’s human resources department. If the problem persists, you can file a complaint with the Ministry of Human Resources and Emiratisation (MoHRE).

Is there a minimum wage in the UAE?

Therefore, there is no minimum wage applicable to expatriates. However, the government frequently issues localized minimum wages, which vary based on the regions and educational levels of employees.

How do free trade zones affect wage verification?

Companies in free trade zones follow different regulations and may have their own systems for wage administration. It is important to check the specific rules of the free trade zone where you work.

Can I use a payroll card to access my salary check UAE?

Yes, payroll cards are a common option in the UAE to receive and access your salary check UAE.

So, what happens if my employer does not comply with the WPS? The employer may face legal penalties, including fines and restrictions on the ability to hire new employees.

Also, if you want to learn more about salary check UAE, Abu Dhabi bank salary check, check our website!