The UAE has become a global business and employment hub. Globally, attracting professionals from different fields. Many wonder about the earning potential within the Emirates. Besides, the UAE is on the list of those offering high salaries. Still, one key question lingers: What’s the Emirati Minimum Salary in the private sector in the UAE?

The UAE doesn’t set a nationwide salary floor like many countries. Instead, it operates under a flexible framework. It was designed to adapt to the country’s economy. But does that mean there’s no salary protection for workers? Not at all! The UAE has implemented several systems. These guidelines ensure fair compensation for employees.

The details of the UAE’s salary structure are going to be shared in this post. Including what workers can expect, and how the system works in 2025.

No National Minimum Wage, But Salary Guidelines Exist

The UAE doesn’t have a national minimum wage. However, the MOHRE provides salary recommendations for different job categories. These aren’t strict laws but serve as helpful guidelines for employers and employees.

In essence, the MOHRE ensures that salaries are enough to meet an employee’s basic needs. While these benchmarks can vary across sectors, most employers follow them to maintain fairness and attract talent.

Salary Guidelines for 2025

Here’s a look at the salary recommendations for various professional categories:

| Professional Category | Recommended Minimum Monthly Salary (AED) | Equivalent in USD |

| University Graduates | AED 12,000 | $3,267 |

| Skilled Technicians | AED 7,000 | $1,905 |

| Skilled Labourers with Secondary Education | AED 5,000 | $1,361 |

These recommendations apply to UAE nationals and expatriates. The rates have remained relatively steady over the years.

Regional Differences in Salary Guidelines

Across the UAE, though, there’s no unified minimum wage. Individual emirates have tailored their salary standards for government employees. Breaking down some of the major emirates:

| Emirate | Minimum Monthly Salary (AED) | Applies To |

| Abu Dhabi | AED 15,300 | Government employees only |

| Sharjah | AED 25,000 | Government employees only |

| Dubai | None | Market-driven rates |

| Other Emirates | Varies | Based on emirate policies |

For example:

Abu Dhabi has set a minimum wage for government workers. This doesn’t apply to private sector employees. In comparison, Dubai relies on market rates. The city doesn’t have a mandated Emirati minimum salary for public or private sector workers.

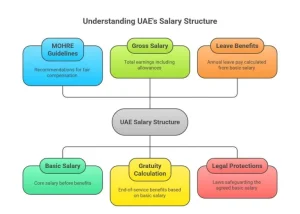

Basic Salary vs. Gross Salary: What’s the Difference?

Understanding the UAE salary structure is important for employees and employers. Two key terms often come up: basic salary and gross salary. Here’s what it means:

Basic Salary: This is the core salary and about 60% of the total pay. It’s what employees get paid before any additional benefits/allowances. Basic salary plays a key role in calculating benefits. It can be benefits like gratuity and annual leave payments.

Gross Salary: The gross salary is the total amount an employee earns. It includes the basic salary plus additional allowances. Including housing, transportation, and other perks. Gross salary is what employees take home. However, basic salary is the foundation for many legal calculations.

Why Basic Salary Matters

- Gratuity Calculation: Workers can claim the gratuity when he/she leave the company. Also called the end-of-service benefits. The gratuity is based on the basic salary, not the gross salary.

- Leave Benefits: Annual leave pay is calculated by the basic salary.

- Legal Protections: Labour laws protect the agreed-upon basic salary, making it harder for employers to reduce this amount after it’s been set in the contract.

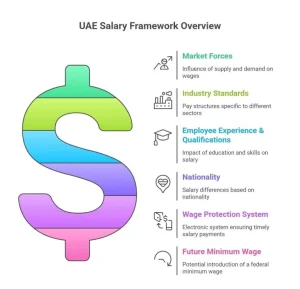

How Emirati Salaries Are Set in the UAE: What Influences Your Pay?

Although the UAE doesn’t have a minimum wage law. But several factors contribute to salary decisions:

- Market Forces: The UAE operates in a free-market economy. Here, supply and demand have a huge role in salary levels. Highly sought-after skills/professions like engineering or IT command higher wages.

- Industry Standards: Different industries have their own pay structures. Due to this, some offer higher compensation based on profitability or skill requirements.

- Employee Experience & Qualifications: Salaries also depend on an employee’s education. Plus his/her years of experience and specialized skills.

- Nationality: While illegal, salary differences based on nationality still exist in some sectors. This is being actively addressed to achieve fairness and equality.

The Wage Protection System (WPS): Ensuring Salary Payments for Emiratis

The Wage Protection System is an electronic system. The WPS is used to pay workers in the UAE. By using it, workers transparently receive their salaries on time. Here’s how it works:

Electronic Payment: Employers must pay salaries through banks or other financial institutions. Should be approved by the UAE Central Bank.

Legal Requirements: Private sector companies and those in free zones, like JAFZA, must submit salary data to the WPS. They do so to comply with the law.

Consequences for Non-Compliance

Employers not follow the WPS guidelines face penalties, including:

- Restrictions on obtaining new work permits

- Suspension of business licenses

- Fines and administrative penalties

This system provides a solid framework to protect employees. Making sure they’re paid fairly and on time.

Emirati Minimum Salary Requirements for Certain Benefits

Even though the UAE doesn’t have a minimum wage. Certain services and benefits do have a minimum salary requirement for Emirati nationals. Essential for workers to access various services. These include health insurance or family sponsorship.

| Purpose | Minimum Monthly Salary (AED) | Notes |

| Health Insurance | AED 4,000 | Lower earners may qualify for the Essential Benefits Plan (EBP) |

| Family Sponsorship (with accommodation) | AED 3,000 | For expatriates with company-provided housing |

| Family Sponsorship (without accommodation) | AED 4,000 | For expatriates arranging their own housing |

| Basic Banking Services | AED 3,000 – AED 5,000 | Varies by bank and service type |

| Credit Cards & Loans | AED 5,000 – AED 10,000 | Depends on the bank and the financial product |

For instance, workers earning less than AED 4,000 may qualify for a basic health insurance plan, while those earning AED 3,000 or more can sponsor their families for residency visas if the company provides housing.

The Future: Could a Minimum Wage Be Coming?

With ongoing changes to the UAE labor law. Particularly under Federal Decree-Law No. 33 of 2021. There’s a discussion of introducing a federal minimum wage in the future. A wage could range from 600 to 3,000 AED per month, as per experts. It primarily depends on factors like the worker’s qualifications.

However, no official minimum wage exists right now. Still, the MOHRE’s salary guidelines and the WPS system make sure that employees are paid fairly and on time.

Conclusion: Navigating the Salary Framework in the UAE

The UAE’s approach to salaries seems unconventional at first glance. However, it’s designed to maintain flexibility. In the meantime, ensuring that workers are treated fairly. UAE workers are protected with salary guidelines, regional differences, and WPS in place. The protection is guaranteed even without a federally mandated minimum salary for Emiratis in Dubai.

Claim Your Right with Emiratisation Nafis Support!

An expatriate or a local should understand the salary structure. The requirements in the UAE will help you make informed decisions. Be sure to research industry standards and keep up with the latest labor law updates. Don’t hesitate to know about your rights as the UAE’s labor market continues to evolve. Difficult to understand? Acquire the assistance of Emiratisation Nafis. We’ll help you get what you deserve based on your skill set and experience.

FAQs for Emirati Minimum Salary

What is the lowest pay that Emiratis can make in the private sector?

There is no mandated national minimum wage. However, Emiratis in skilled jobs can make a suitable income per month.

Who makes the regulations for the Emirati minimum wage?

There is no statutory minimum wage, although MOHRE establishes minimum compensation recommendations for skilled jobs.

Do Emirati workers get extra Nafis perks on top of their pay?

Yes, Nafis gives eligible Emiratis advantages like extra pay, children’s allowances, and help with pension contributions.

Do businesses have to pay the Emirati minimum wage?

There is no minimum salary to pay Emirati. However, companies need to meet the target of hiring Emiratis based on quotas to comply with rules.

Is it possible for Emirati salaries to be different across various Emirates or different sectors?

Yes, incomes vary from one Emirate to another and from one industry to another. Abu Dhabi and Dubai usually pay more than the other Emirates.